By 2025, Medicare Part D has changed more in the last two years than it has in the last 15. If you’re on Medicare and take prescription drugs, you need to know how the new rules affect your wallet. The big news? You’ll never pay more than $2,000 out of pocket for your medications in a single year - no matter how expensive your drugs are. That’s not a suggestion. It’s the law.

What Medicare Part D Actually Covers

Medicare Part D is prescription drug coverage. It’s not automatic. You have to sign up for it separately, either through a standalone plan (PDP) or as part of a Medicare Advantage plan that includes drug coverage (MA-PD). It covers both brand-name and generic drugs, but not every drug. Each plan has its own list - called a formulary - that says exactly which medications are covered and at what cost.

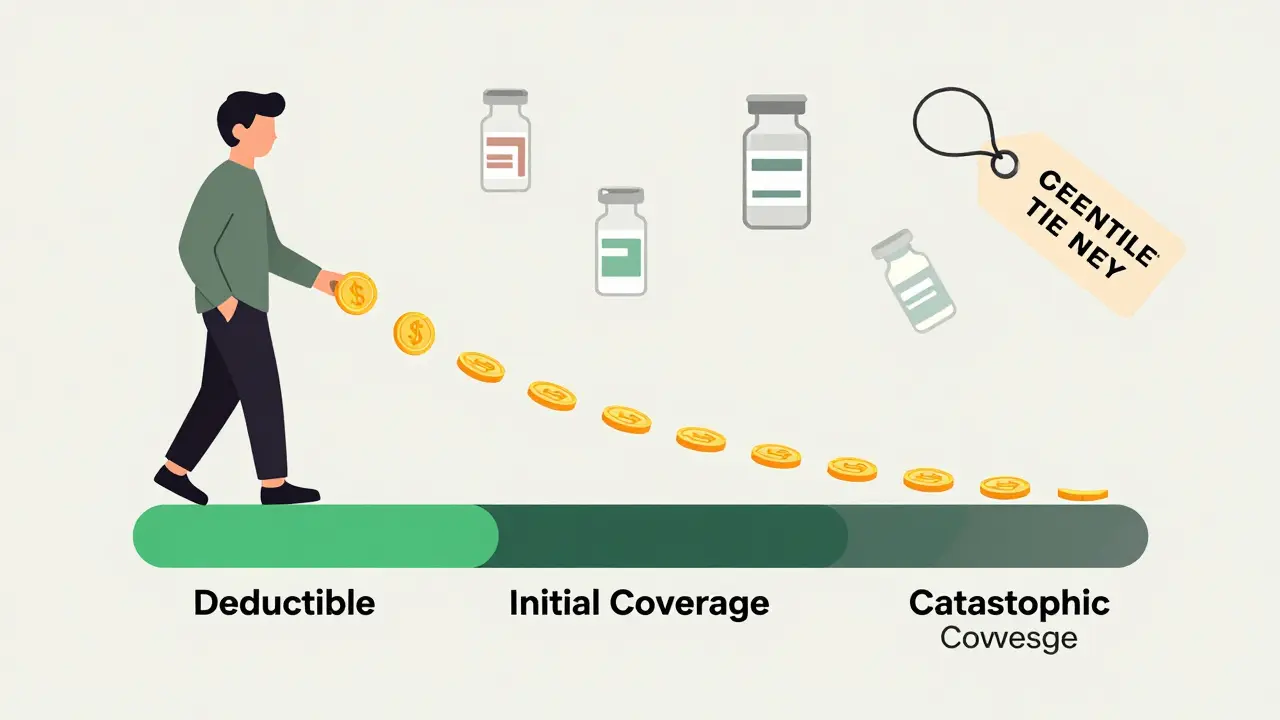

Before 2025, the system was confusing. You had four phases: deductible, initial coverage, coverage gap (the "donut hole"), and catastrophic coverage. Now? It’s three phases. The coverage gap is gone. That means no more guessing whether you’re in the hole, how much you owe, or when you’ll get out. The system is simpler. But that doesn’t mean it’s easy to navigate.

The Three Phases of Part D in 2025

1. Deductible Phase

You pay 100% of your drug costs until you hit the deductible. In 2025, the maximum deductible is $590. Some plans have lower deductibles - even $0. But if a plan has no deductible, it usually means higher copays or premiums later. You need to check the full picture.

2. Initial Coverage Phase

After you pay the deductible, you enter this phase. Here, you pay 25% of the drug cost. The plan pays 65%. The drug manufacturer pays 10% through a discount program. That’s right - the manufacturer helps cover part of your cost. This phase continues until your total out-of-pocket spending on covered drugs hits $2,000. That includes your payments, the manufacturer discount, and any help from Extra Help (the low-income subsidy). It does NOT include your monthly premium.

3. Catastrophic Coverage Phase

Once you hit $2,000, you’re done paying. For the rest of the year, you pay $0 for covered Part D drugs. That’s it. No more coinsurance. No more copays. The plan pays 60%, the manufacturer pays 20%, and Medicare pays 20%. You pay nothing. This is the biggest win of the 2025 redesign.

How Much Do You Really Pay? Premiums vs. Out-of-Pocket

Let’s clear up a common mistake. The $2,000 cap is only for what you pay for drugs - not your monthly premium. You still pay your plan’s premium every month, whether you use your drugs or not. For stand-alone Part D plans, the average monthly premium in 2025 is $45. For Medicare Advantage plans with drug coverage, it’s $7. That’s a big difference. So if you’re on a $45 plan, you could pay $540 in premiums plus $2,000 in drug costs - totaling $2,540 for the year. But you’ll never pay more than $2,000 for the drugs themselves.

And here’s the catch: if you don’t take any drugs, you still pay the premium. That’s why some people choose a low-premium plan, even if they don’t need drugs right now. Why? To avoid the late enrollment penalty. If you go without creditable drug coverage for more than 63 days after your Initial Enrollment Period, you’ll pay a penalty for as long as you have Part D. It’s 1% of the national base premium ($35.37 in 2024) for every month you delay. That adds up.

Insulin and Other Key Protections

Insulin is capped at $35 per month - no matter which plan you choose. That hasn’t changed since 2023. If you use insulin, this is huge. You’ll pay $35, even if your plan’s normal copay is $100. Same goes for certain vaccines. The flu shot, pneumonia shot, and shingles vaccine are covered at $0 cost-sharing under Part D. You don’t pay anything for them.

But not all drugs are treated the same. Most plans use a five-tier system:

- Tier 1: Preferred generics - lowest cost

- Tier 2: Generics - slightly higher

- Tier 3: Preferred brands - moderate cost

- Tier 4: Non-preferred brands - higher cost

- Tier 5: Specialty drugs - highest cost, often hundreds per month

If your drug is on Tier 5, you’ll pay more in the initial coverage phase. But once you hit $2,000, you pay $0 for it too. So even expensive drugs are covered fully after the cap.

Choosing the Right Plan

You have options. In 2025, the average Medicare beneficiary can choose from 48 Part D plans - 14 stand-alone and 34 bundled with Medicare Advantage. That’s fewer than last year, but still plenty. The trick is matching your drugs to the plan’s formulary.

Don’t pick a plan just because it has the lowest premium. A $0 premium plan might have a $590 deductible and high copays for your meds. A $50 premium plan might have no deductible and low copays. You need to run the numbers.

Use the Medicare Plan Finder tool on Medicare.gov. Enter your medications, dosages, and pharmacy. The tool will show you the total estimated cost for the year - premiums plus out-of-pocket drug costs. That’s the number that matters. Don’t just look at the monthly premium.

Also, check the pharmacy network. Is your local pharmacy in-network? If you use a mail-order service, is it covered? If your pharmacy isn’t in the network, you’ll pay way more - or nothing at all.

Who Gets Extra Help?

If your income is low, you might qualify for Extra Help - a federal program that reduces your premiums, deductibles, and copays. In 2025, 90 stand-alone Part D plans are available with $0 premium for people getting Extra Help. These are called "Benchmark Plans." They’re the same as the lowest-cost plan in your area, but the government pays the rest.

You don’t need to apply separately for Extra Help if you get Medicaid, Supplemental Security Income (SSI), or certain other programs. But if you’re unsure, call 1-800-MEDICARE or visit your local State Health Insurance Assistance Program (SHIP). They’ll help you figure it out - for free.

What’s Not Covered

Part D doesn’t cover everything. You won’t find these on any formulary:

- Drugs for weight loss or hair growth

- Over-the-counter medications

- Drugs bought outside the U.S.

- Some vaccines (like travel vaccines)

Also, Part D doesn’t fix high drug list prices. The $2,000 cap protects you from paying too much, but the list price of a new drug can still be $10,000 a year. The manufacturer discount helps, but the system still relies on those high prices to fund the discounts. That’s a problem experts are still trying to fix.

When to Enroll - And When to Switch

You get one chance a year to change your plan: the Annual Enrollment Period, from October 15 to December 7. Changes take effect January 1. If you miss it, you’re stuck until next year - unless you qualify for a Special Enrollment Period (like moving or losing other coverage).

Even if you’re happy with your plan, review it every year. Formularies change. Prices change. Your meds might change. A plan that was perfect last year might not be this year.

And if you’re turning 65? Enroll during your Initial Enrollment Period - the 7 months around your birthday. If you don’t, you’ll pay the late penalty forever.

What People Are Saying

Beneficiaries who’ve used the new system say the biggest relief is not having to track the donut hole anymore. "I used to stress every time I filled a prescription," one user wrote. "Now I just know I won’t pay more than $2,000. That’s peace of mind." But confusion still exists. Many think the $2,000 cap includes their premium. It doesn’t. Others assume their plan covers all their drugs - until they get a bill. Formularies change without notice. Always double-check.

And here’s a sobering stat: 68% of Medicare beneficiaries didn’t know about the 2025 changes. Don’t be one of them. Talk to someone. Use the tools. Call 1-800-MEDICARE. Visit your local SHIP office. They helped 5.2 million people last year. They can help you too.

What’s Next?

The $2,000 cap will rise to $2,100 in 2026, then adjust yearly for inflation. More changes are coming - like price negotiations for some high-cost drugs starting in 2026. But for now, the 2025 redesign is the biggest win for Medicare drug users in decades.

You’re not powerless. You don’t have to guess. You don’t have to pay thousands for your meds. The system is built to protect you. You just need to know how it works - and use it right.

Is the $2,000 out-of-pocket cap for Medicare Part D per year?

Yes. The $2,000 cap is the maximum you’ll pay for covered prescription drugs in a calendar year. Once you hit that amount, you pay nothing for the rest of the year. This includes your copays, coinsurance, and the manufacturer discount, but not your monthly premium.

Do I still have to pay a monthly premium for Part D?

Yes. The $2,000 cap only covers what you pay for your drugs. You still pay your plan’s monthly premium, no matter how much or how little you use your coverage. Premiums vary - from $7 for Medicare Advantage plans to $45 for stand-alone plans on average.

What happens if I don’t enroll in Part D when I’m first eligible?

If you go without creditable drug coverage for more than 63 days after your Initial Enrollment Period, you’ll pay a late enrollment penalty. It’s 1% of the national base premium ($35.37 in 2024) for every month you delay. This penalty lasts as long as you have Part D coverage. Even if you don’t take drugs now, a low-premium plan can protect you from this fee.

Can I switch my Part D plan anytime?

You can only switch during the Annual Enrollment Period (October 15 to December 7) unless you qualify for a Special Enrollment Period. Examples include moving out of your plan’s service area, losing other coverage, or getting Extra Help. Outside those windows, you’re locked in until next year.

Are all my medications covered under Part D?

No. Each plan has its own formulary - a list of covered drugs. Some plans don’t cover certain brand-name drugs or specialty medications. Always check if your specific drugs are on the formulary before choosing a plan. Use the Medicare Plan Finder tool to compare coverage for your exact medications.

Does Part D cover insulin?

Yes. All Medicare Part D plans cap insulin costs at $35 per month in 2025. This applies regardless of the plan you choose, your income, or how much insulin you use. It’s a fixed benefit - no extra paperwork needed.

What if my drug isn’t on my plan’s formulary?

You’ll pay full price out of pocket unless you get an exception. You can ask your plan for a formulary exception - a request to cover your drug. You’ll need your doctor to explain why it’s medically necessary. If denied, you can appeal. Or, you can switch plans during Open Enrollment to one that covers your medication.

Written by Felix Greendale

View all posts by: Felix Greendale